Overview

It is a known fact that over 50 percent of M&A transactions fail. In today's market where growth is a top priority, it is more imperative than ever to avoid the notorious M&A “winner’s curse” and ensure inorganic growth options stay viable and accretive. The notorious M&A “winner’s curse” is prevalent because many companies get so focused on the acquisition prize that emotional escalation, egos, tunnel-vision, cultural misalignment, and biases get in the way of sound, value maximizing decision-making across the entire M&A lifecycle. Such an approach followed by the accompanying failed acquisition can quickly dilute a company's value and halt its growth efforts.

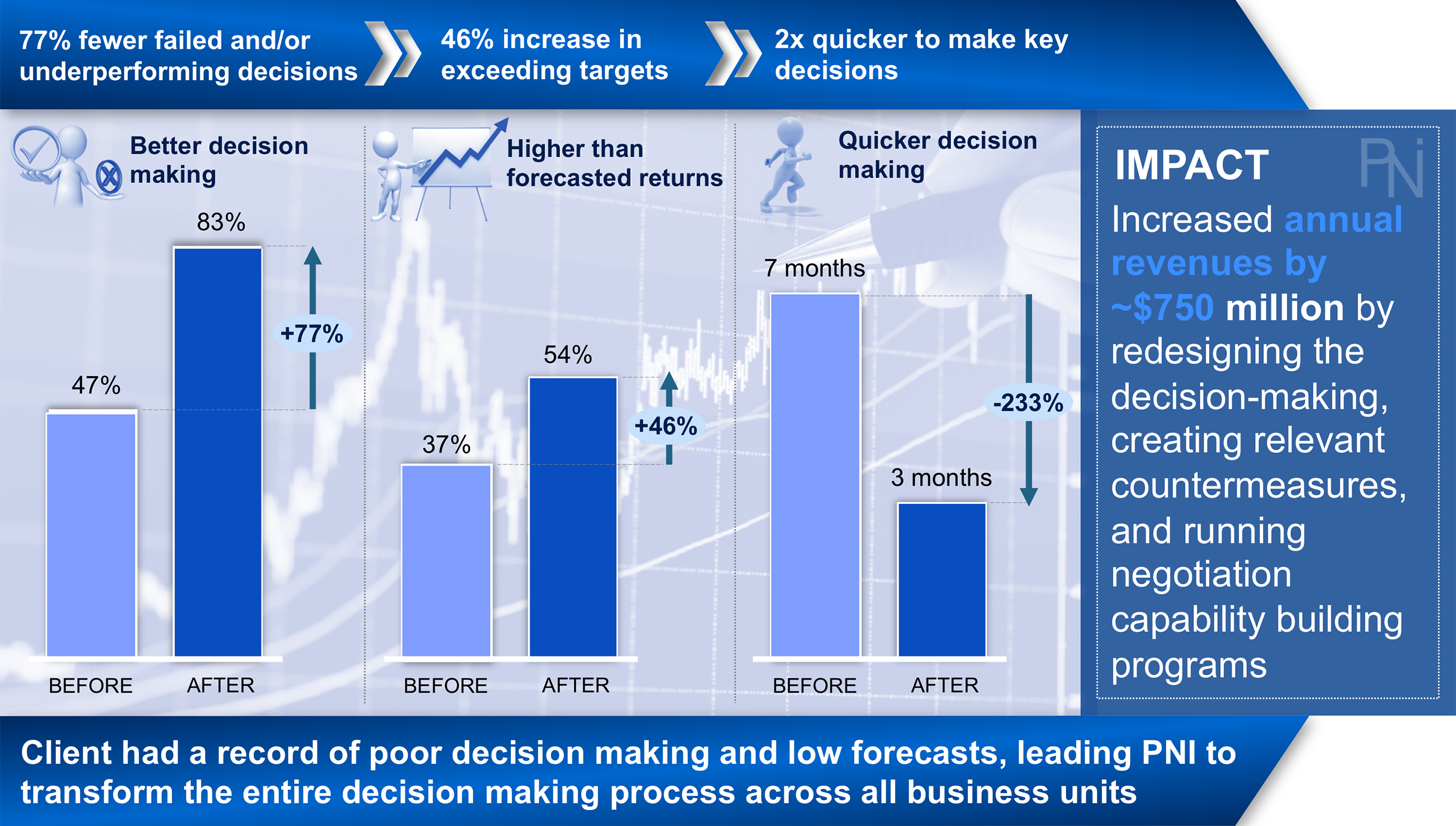

Exhibit 2 (Click to Enlarge)

Exhibit 3 (Click to Enlarge)

We help clients transform the entire acquisition lifecycle by leveraging our proprietary 360° M&A framework and 360° omni-stage decision-making model to ensure value maximizing deals (See Exhibits 1, 2, and 3). PNI’s holistic 360° M&A process ensures focus on the complete acquisition lifecycle, including (1) due diligence, (2) at-the-table negotiations, and (3) post-merger integration. Deals fail because of a single-minded focus on only one of these stages, which compromises the entire deal. Simply, there is a decision-making gap because of a failure to consider the entire acquisition lifecycle (See Exhibit 2). At each phase, we use comprehensive and proprietary frameworks, ensuring a constant 360° view that creates an omni versus multi-stage decision-making mindset. At stage #1 (due diligence), we leverage our 6-step decision-making transformation framework. At stage #2 (at the table negotiations), we leverage our 6-step negotiation transformation framework. Finally, at stage #3 (post-merger integration) we leverage our vast transformation and integration frameworks, including our renowned culture, digital, customer experience, and sales frameworks to not only meet but also exceed synergies. This approach replaces the winner’s curse with the winner’s prize.

360° M&A Framework

Our 360° Framework

Most companies approach deal making merely as an art rather than as a corporate capability. Successfully driving inorganic growth is complex, and as such we help clients significantly improve their M&A and PE acquisition process via our 360° acquisition framework which drives greater total shareholder returns. Simply, PNI’s 360° M&A framework covers the entire acquisition lifecycle, leveraging an omni vs. multi-stage decision-making mindset for accretive deals. Multi-stage decision-making occurs when a deal team thinks through each stage individually versus taking into account every facet (pre and post merger). For example, during the due diligence stage it's often the case the cultural alignment and operational fit don't get properly assessed because the integration step (Phase 3) is glossed over until the financial modeling in the due diligence period completes. This creates tunnel vision and value erosion. Instead we ensure M&A winners. We accomplish this by ensuring an omni-stage decision-making mindset by concurrently thinking about every step in the journey whether in the due diligence, negotiation, or integration stages.

Phase 1

Holistic due diligence leveraging proprietary decision-making, cultural alignment analysis, financial modeling, and post-merger review to ensure value maximizing acquisitions (See details below)

Phase 2

High-stakes negotiation capability building to ensure at the table discussions are not led by gut but rather quantitative rigor and proprietary acquisition negotiation models (See details below)

Phase 3

Comprehensive cross-organizational health integration to ensure cost and revenue synergies are met via proprietary culture, employee, ops, digital, customer, & sales models (See details below)

Due Diligence Stage Overview

Due Diligence

- Phase 1 -

Exhibit 4 (Click to Enlarge)

A careful examination of the high rate of M&A failures illustrates the likelihood that corporate negotiations are strewn with psychological barriers that stand in the way of efficient agreements. Indeed, more often than not, the critical due diligence decision-making stage leads to significant money left on the negotiating table in the form of: (1) overestimated, unrealistic synergic targets, (2) cultural misalignments, and (3) lack of post-merger integration analysis rigor. Simply, left unchecked, subconscious biases undermine due diligence decision-making, an inflated purchase price growth, and negative ROI. On the opposite side of this spectrum, those that improve their decision making can witness far greater M&A success and significant ROI increases. Thus, due diligence decision-making can either be value erosive or value maximizing. PNI helps the world's most sophisticated companies transform its M&A decision-making capabilities via leveraging our proprietary 6-step decision-making framework, ensuring mitigation of value erosive decision-making (See Exhibit 4). We diagnose the existing decision making, identify the root causes of value eroding biases, redesign the decision-making system, and institutionalize the revised decision-making system via capability building, feedback mechanisms, and metrics/continuous audits.

Exhibit 5 (Click to Enlarge)

Companies that exhibit poor decision-making are 32 percent more likely to pass up good investments. In addition, we see that biases can decrease the returns on a company’s investments by 31 percent (See Exhibit 5). In one of our recent surveys among Fortune 500 and PE executives, reducing decision biases was ranked as the number 1 aspiration for improving performance, both internally and across M&A dealmaking. Simply, 76 percent noted they were taking too much or too little risk, 67 percent were over or under investing, and 93 percent did not reach target forecasts. In a couple recent McKinsey surveys, only 28 percent said that the quality of strategic decisions in their companies was generally good due to prevailing biases and 60 percent thought that bad decisions were about as frequent as good ones.

Exhibit 6 (Click to Enlarge)

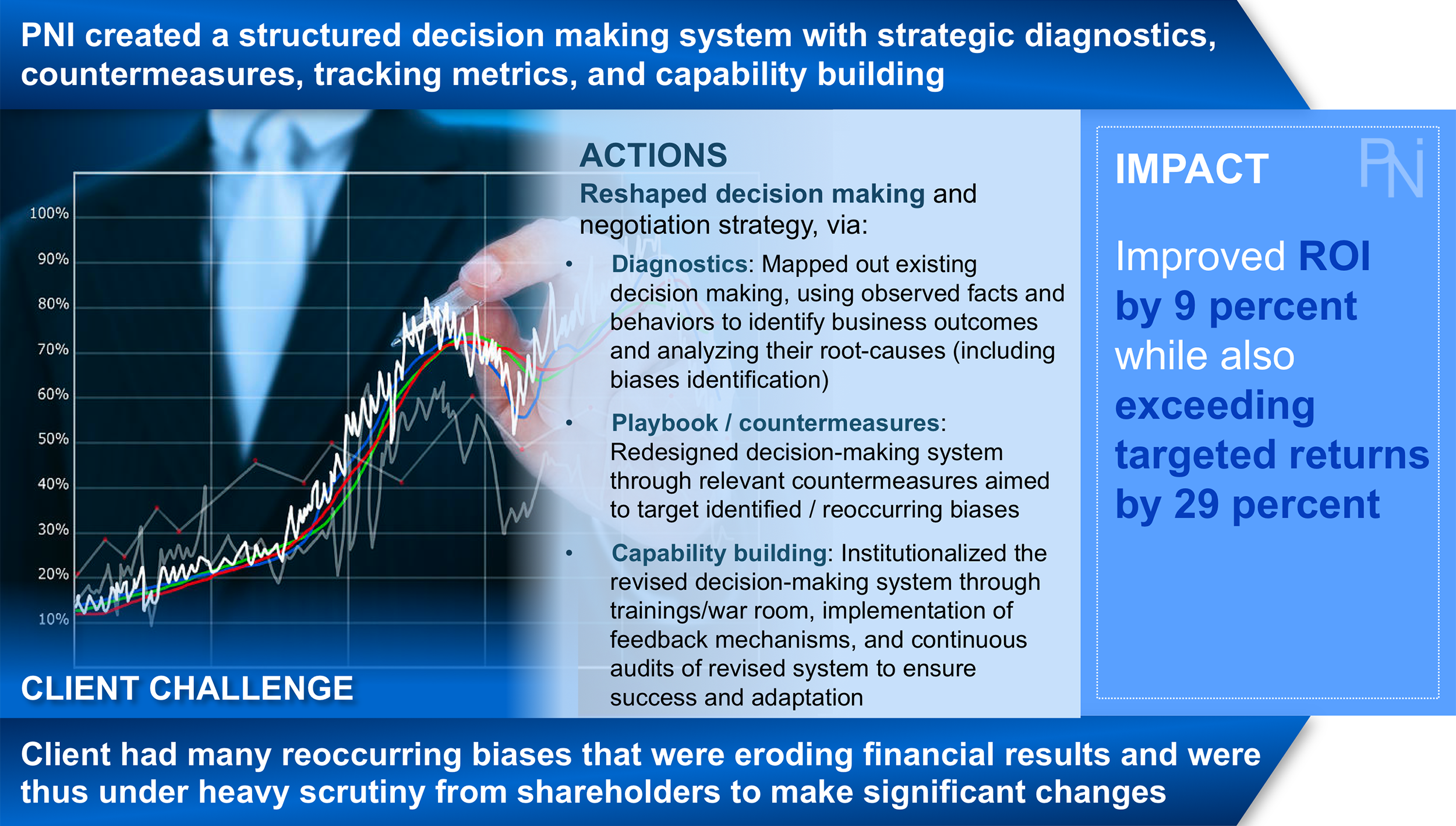

Yet, very few corporations implement measures to combat this value destructive decision-making across its M&A process. This ultimately leads to value erosive decisions that deviate from rational calculations. On the opposite side of this spectrum, those who improve their decision making from the bottom to top quartile can see at least a 7 to 9 percent ROI increase while improving shareholder returns by anywhere from 28 to 77 percent (See Exhibit 6). Simply, decision making can either be value erosive or value maximizing. We ensure the due diligence stage sets up the M&A process for success by (1) diagnosing the existing process, (2) leading a creation of M&A decision-making playbooks and checklists, and (3) ensuring KPI’s are in place that incentivize a 360° view of the process, ensuring value added omni versus multi-stage decision-making.

Negotiation Stage Overview

High Stakes Negotiations

- Phase 2 -

Exhibit 7 (Click to Enlarge)

One of our recent surveys of over 1,000 Fortune 500 and PE executives indicated that corporate leaders see the lack of negotiation preparation and proper execution as the number one reason for M&A or PE failure. Through our proprietary tools and training we mitigate these concerns by transforming the acquisition decision-making and negotiation protocols. Simply, we turn acquisition decision-making and negotiations into a strategic capability that allows our clients to have a significant competitive advantage that their peers will struggle to replicate. We have developed a proprietary M&A negotiation framework in which we take our clients through a holistic six-step transformation process, including our 10 best M&A negotiation practices playbook (See Exhibits 7 and 8).

Exhibit 7 (Click to Enlarge)

Acquisitions, rather public or private, offer untapped potential for companies to grow. Yet one of the most important, yet often overlooked, steps in generating higher acquisition returns is to have a finely tuned negotiation strategy. Poor negotiation capabilities lead to: (1) inflated purchase price with unrealistic synergic targets, (2) escalated transactional costs, and (3) eroded shareholder returns. To successfully navigate these complexities, we help our clients not only with the pre-merger preparation and decision-making but we also ensure that acquisition negotiations have: (1) expedited processes that decrease transactional costs and tension, (2) pragmatic decision making to ensure appropriate synergy targets and optimized purchase price, and (3) collaborative discussions which lead to an increased bargaining zone and mutually beneficial agreements.

Exhibit 8 (Click to Enlarge)

Post acquisition, clients will be equipped not only with our proprietary playbooks and capability building protocols but also be well positioned to apply our negotiation frameworks to other acquisitions, ensuring continual inorganic growth success (See Exhibit 8). Benefits include:

- Increasing the likelihood of reaching an agreement by ~78 percent (See Exhibit 7)

- Improves capability building, allowing for ~55 percent greater likelihood of the opponent accepting the offer you present (See Exhibit 7)

- Enlarges the pie and increases the likelihood of reaching a Pareto optimal outcome by ~96 percent (See Exhibit 7)

- Increases bargaining zone capture, allowing for ~28 to 77 percent higher return to shareholder

- Provides a platform to scale capabilities across the entire M&A and/or PE team for future dealmaking

Integration Stage Overview

Post-Merger Integration

- Phase 3 -

Even if the "winner's curse" is temporarily avoided, without a rigorous and strategic post-merger integration, significant value erosion will quickly transpire. We offer comprehensive post-merger integrations to ensure cost and revenue synergies are not only met but exceeded. We accomplish this via our proprietary culture, organizational health, digital transformation, customer experience, sales & marketing models, operations, and growth frameworks (see frameworks below).

Integration Frameworks by Category

Culture

Org Health

Digital at Scale

Customer Success

Sales Effectiveness

Growth Strategy

Examples of Our Work

Client Results

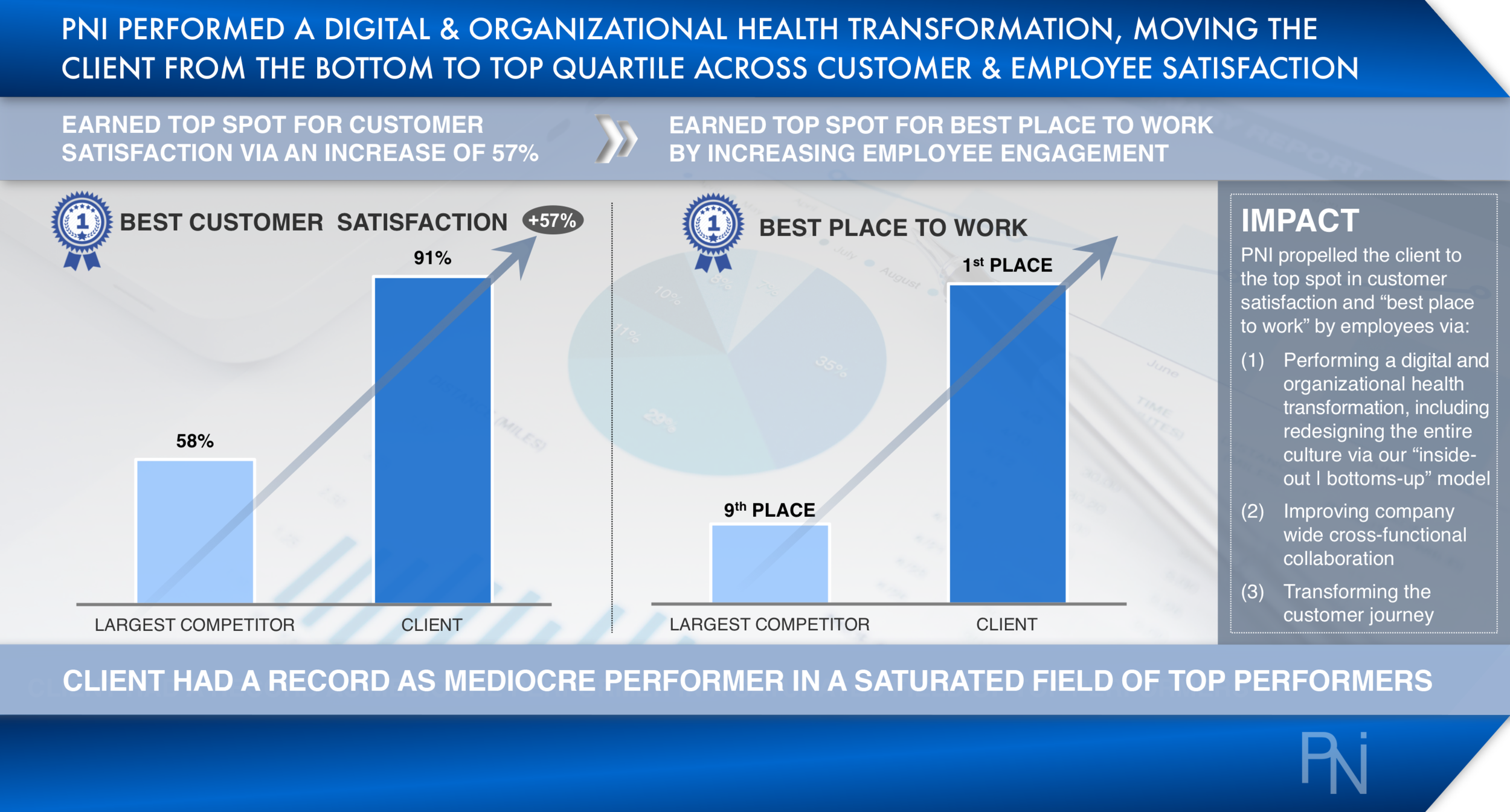

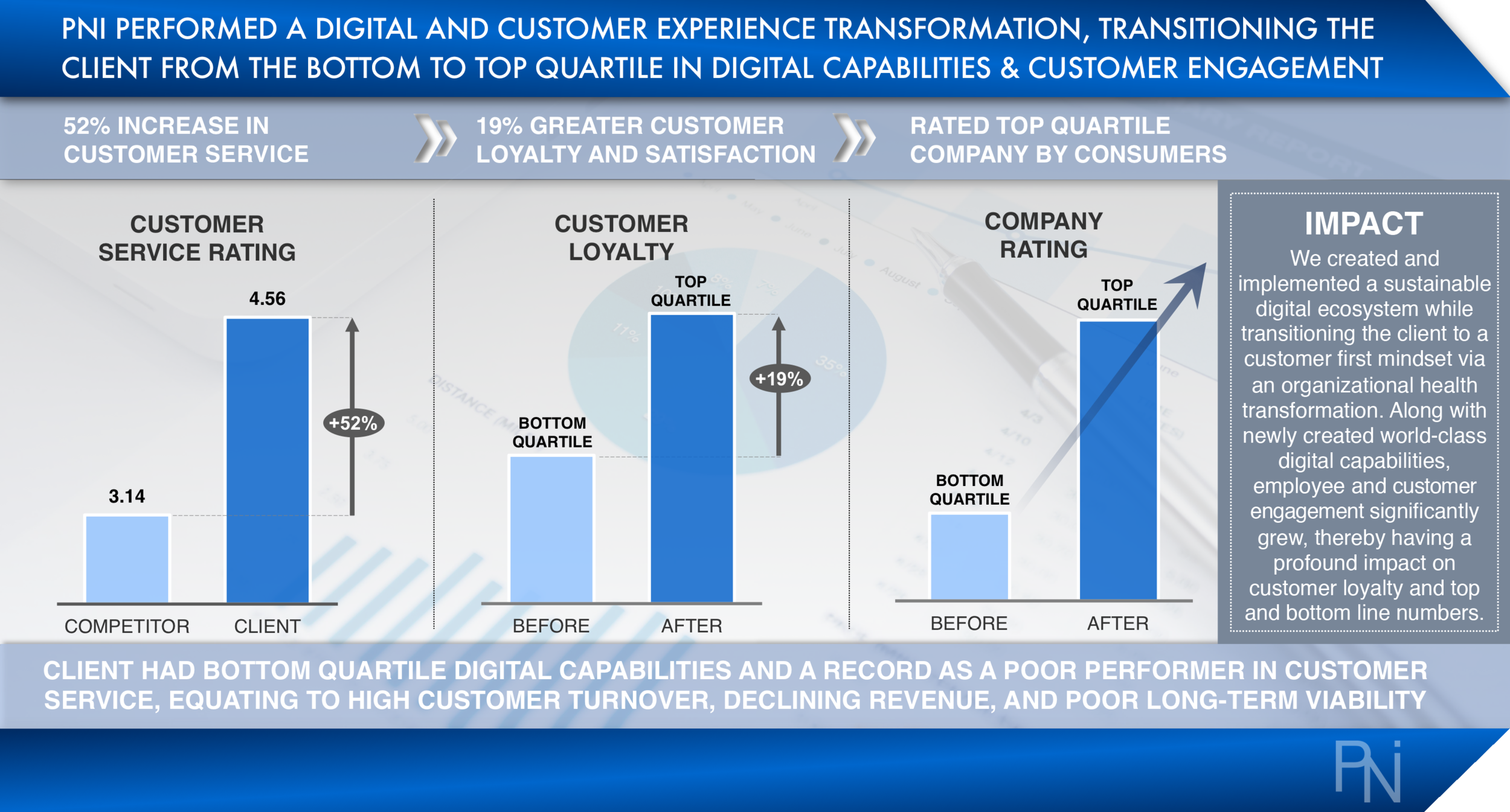

We have helped clients significantly increase their M&A and PE decision-making, optimizing purchase price while simultaneously ensuring targeted synergies are reached or exceeded. Examples of our work include:

Exhibit 10 (Click to Enlarge)

- Example #1: Reduced time to acquisition by 60 percent, decreased transaction costs by 56 percent, and increased RTSR by 43 percent (when compared to previous acquisitions) by (1) leading debiasing decision-making protocols, (2) creating and implementing war room negotiation training, and (3) mediating and managing at the table acquisition and contract negotiations (See Exhibit 10)

Exhibit 11 (Click to Enlarge)

- Example #2: Exceeded targeted run-rate cost synergies by 47 percent and exceeded revenue synergies by 17 percent by (1) leading an M&A management transformation, (2) running an executive decision-making debiasing, (3) leading at-the-table discussions, and (4) managing contract negotiations (See Exhibit 11)

- Example #3: Created ~77 percent higher return to shareholder (RTSR) than the industry average by (1) employing executive level decision making (debiasing) implementation, (2) creating and leading negotiation war room trainings, and (3) managing at the table M&A negotiations

SEE BELOW OR CLICK HERE TO SEE MORE RESULTS.

Additional Client Results

Additional Transformation Services

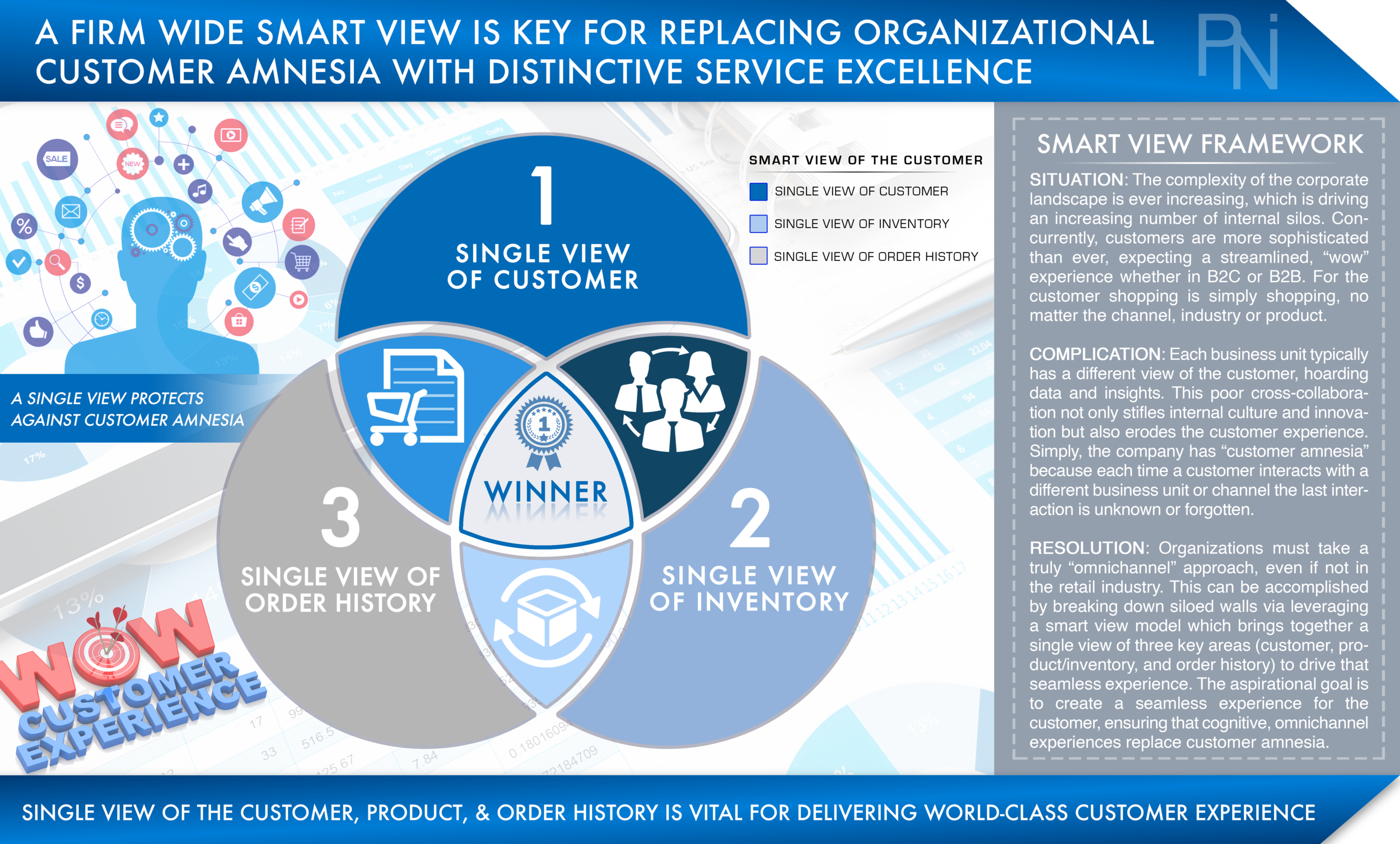

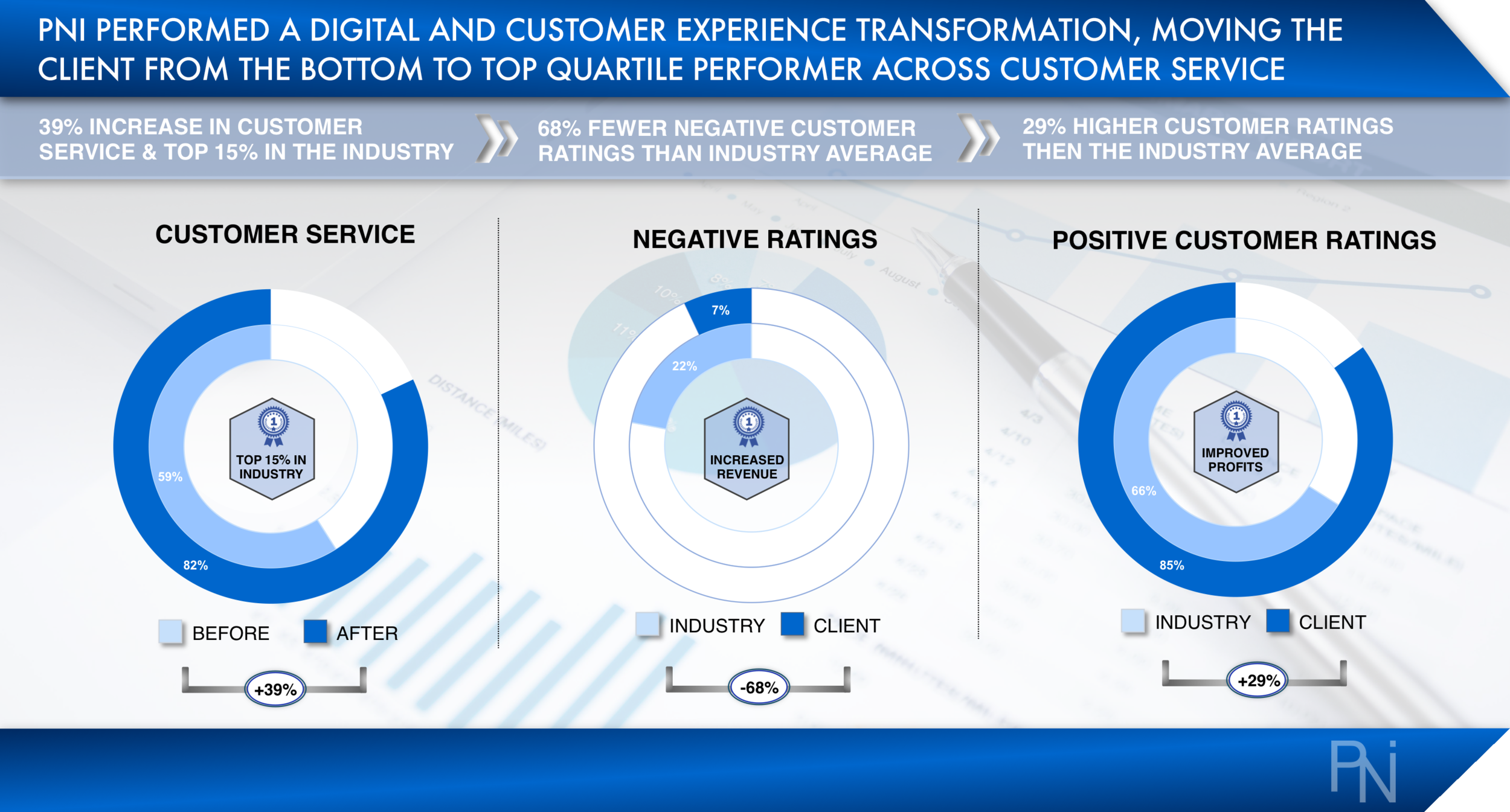

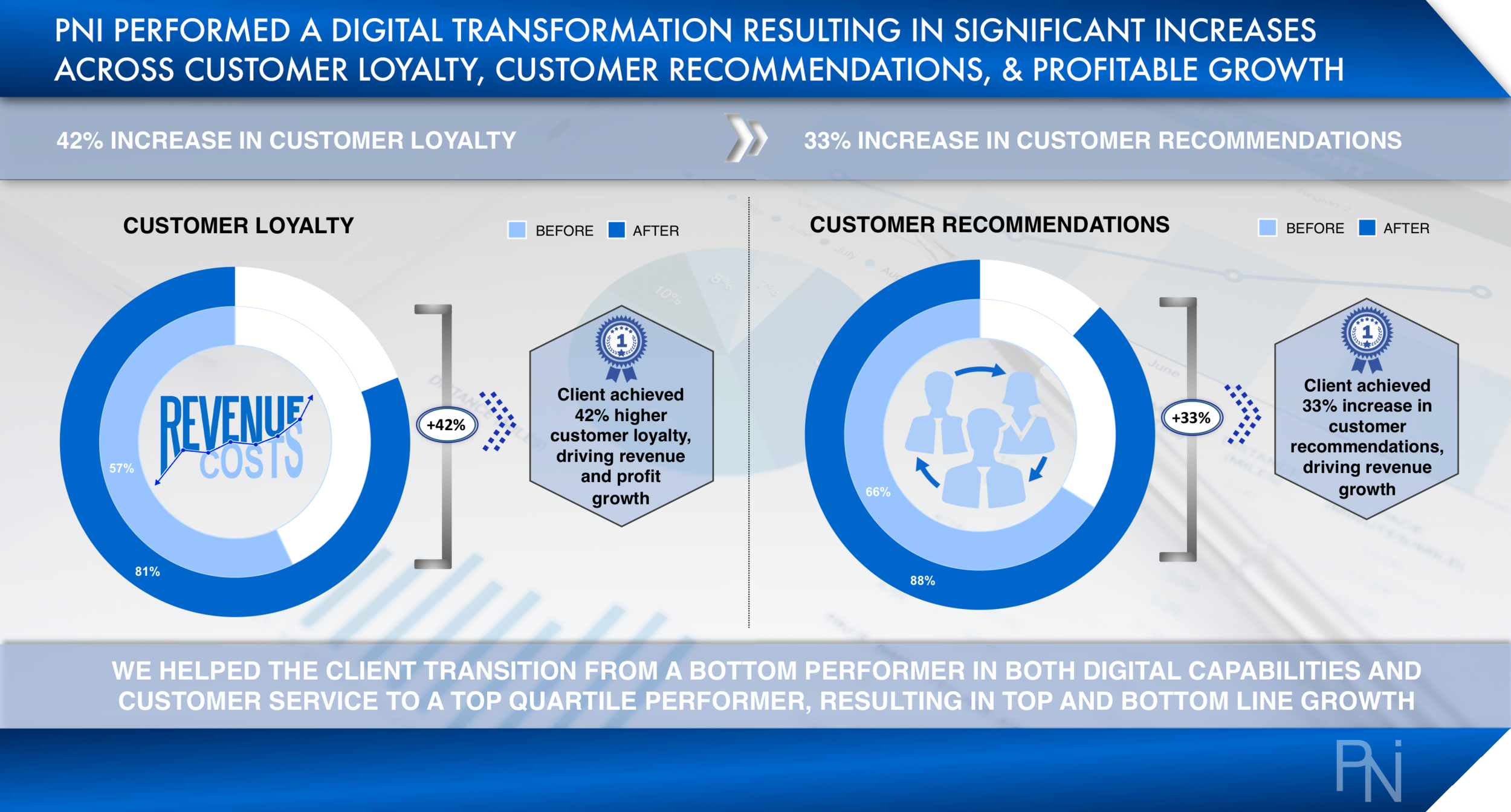

Our customer experience work ensures top customer engagement/loyalty, top quartile net promoter scores, and a pain-point free customer journey, equating to 12 percent and greater revenue increases

Our digital transformation engagements drive significant growth, innovation, and organizational success ensuring distinctive (1) employee empowerment, (2) product differentiation & (3) customer experience

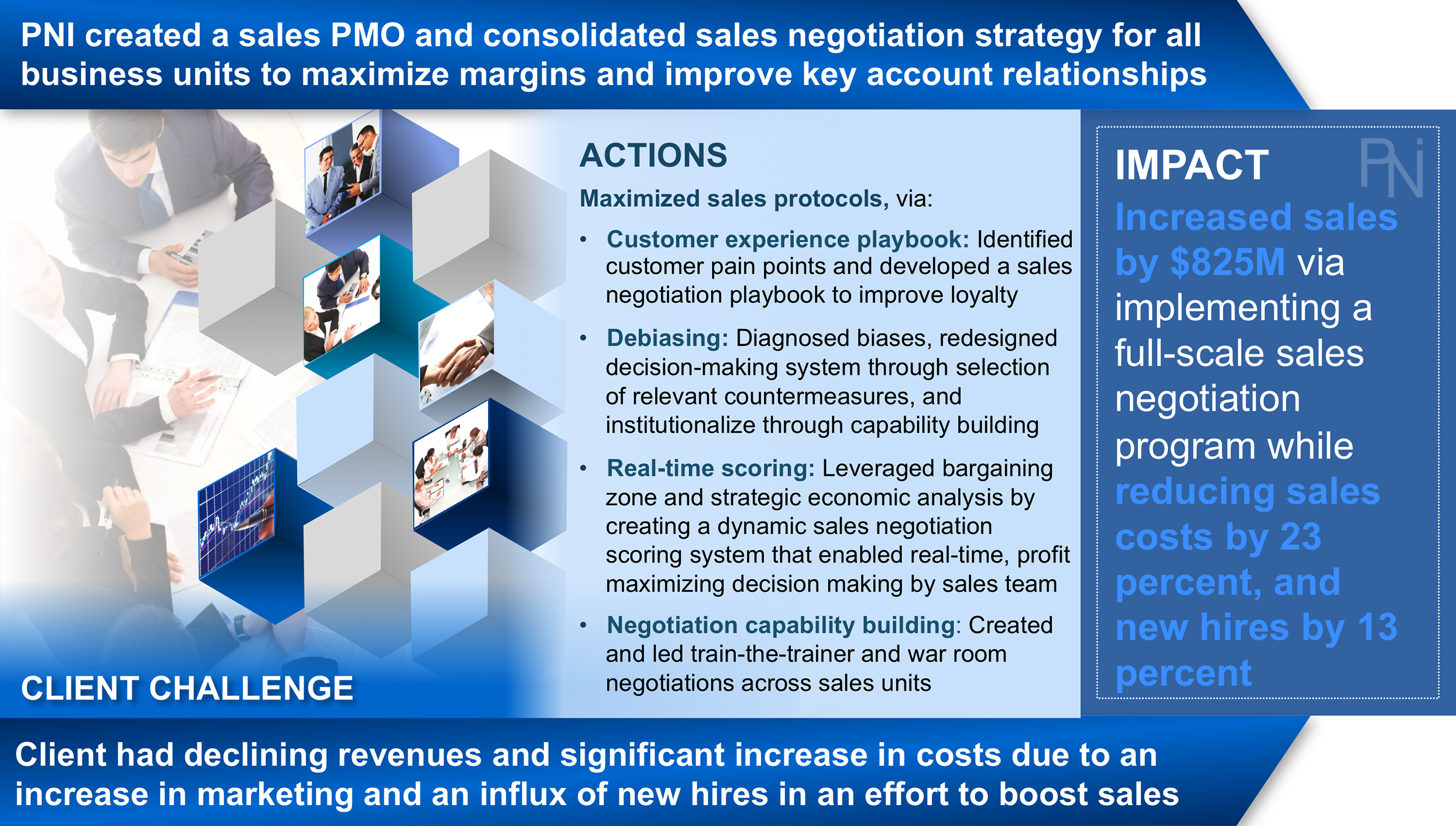

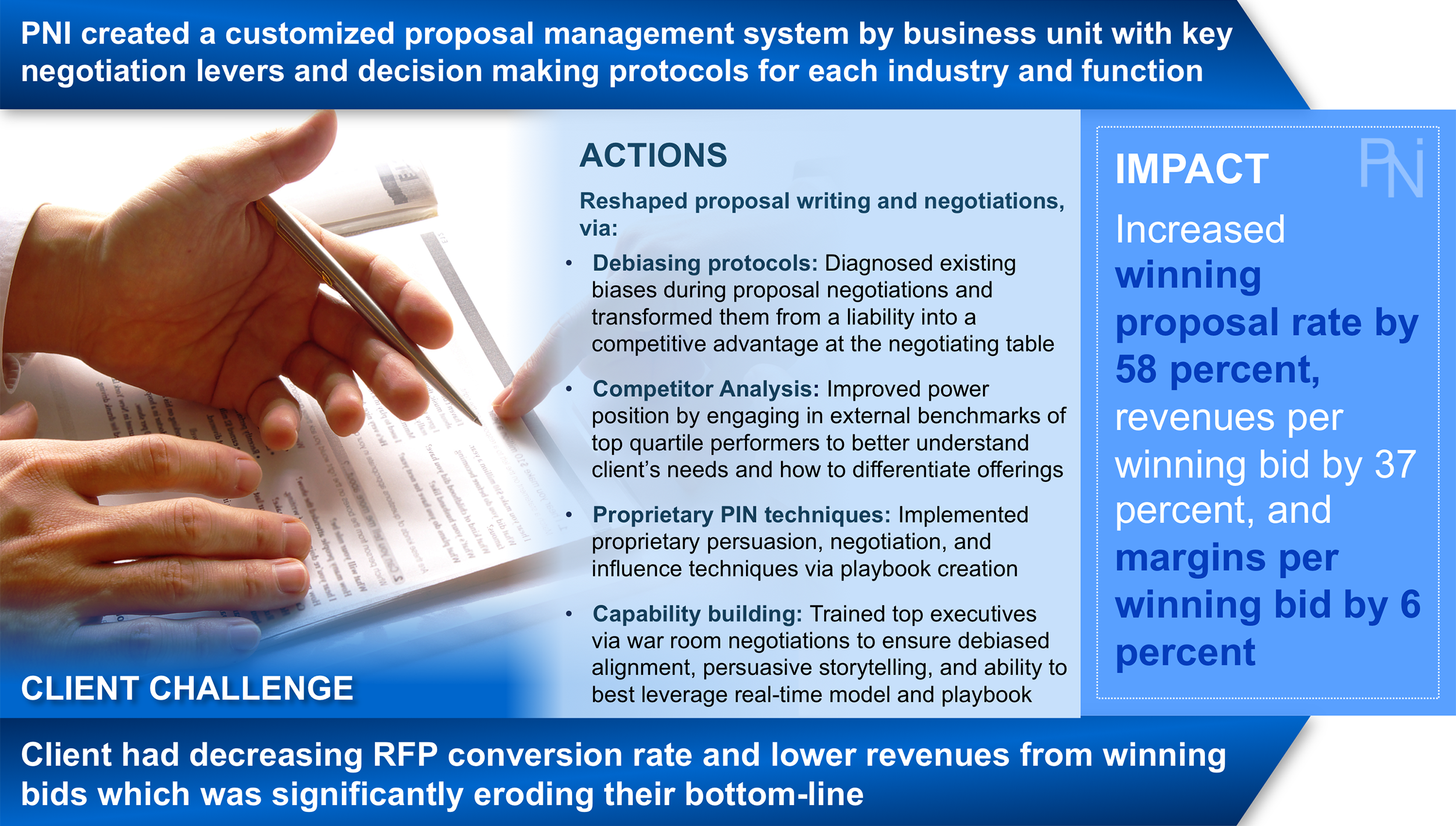

Our sales transformations includes key negotiation and behavioral science levers, allowing our clients to experience revenue improvements of 12 to 33 percent and margin increases from 6 to 17 percent

We help clients improve their decision-making protocols via debiasing initiatives, resulting in 8 to 15 percent improvement in ROI and ~29 percent increase in the likelihood of exceeding targeted returns

Our contract transformations increase profits up to 31 percent, improve the likelihood of reaching an agreement by ~95 percent, and increase chances of Pareto efficiency by ~139 percent

We help clients unlock key account value while improving the customer journey via elimination of pain points, enabling 11 to 17 percent revenue growth and 8 to 15 percent margin increase